Find Out How We Can Help You With Your Art Investment/Collection

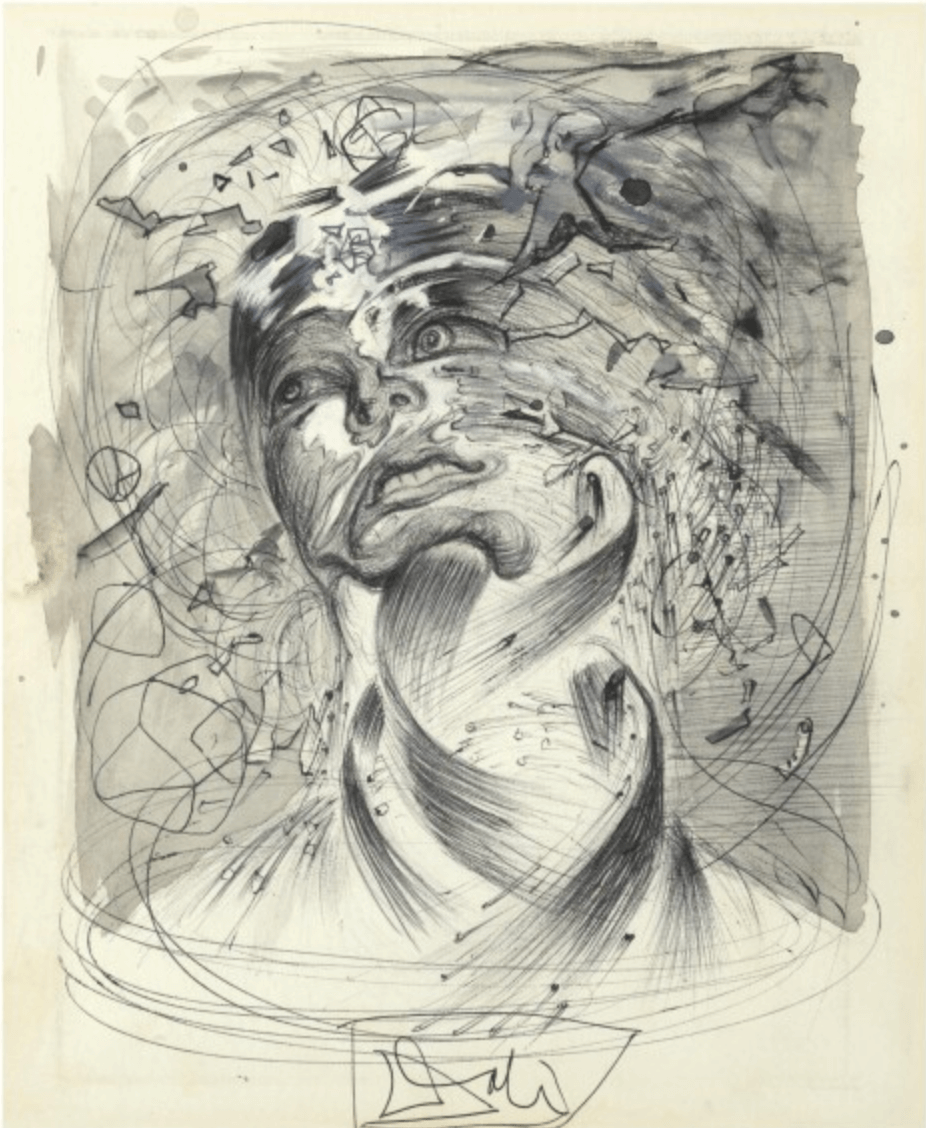

Is it your time for Dali or should you pick Picasso?

IT DEPENDS ON YOUR CHOICE OF PERFORMANCE METRIC WEIGHTS.

Have you considered investing in fractional ownership and/or collecting art, but hesitated because you could not decide which artist would have the best investment potential for you? We can show you how to tailor your art buying decisions to your financial investment goals.

Our proprietary and patented technology uses four performance metrics that allow consistent comparison of artists as diverse as Warhol and Monet, Hirst and Picasso, Kusama and Rubens.

What are the metrics?

Users will be asked to assign a weight to each of the following four performance metrics.

Each artist has a unique numerical value for each of the four-performance metrics based on historical results in the repeat sale auction market.

Complete investment evaluation in just a few clicks

To determine an artist investment potential (AIP) the user must specify their own relative weights to apply to each of the four performance metrics based on their investment goals and risk tolerances. Multiplying each of the four metrics by the chosen weights and then adding them together yields a result where the artist with the smallest positive AIP value has the best investment potential and the artist with the highest AIP value would have the weakest investment potential.

Each set of weights yields a unique AIP score for each artist. Artists’ AIP values can be compared by the user as a way of facilitating the selection of an artist for investment. There is no one correct set of weights their values are personalized and therefore not comparable across users.

| PICASSO AIP | DALI AIP | CROWD PICASSO AIP | CROWD DALI AIP |

|---|---|---|---|

| - | - | - | - |

Submit your weight to get the result to compare with the crowd source data. See how the AIP results change as you change your weights.

Can you do better or worse?

Become A Member

Find out your AIP results for 970 of the most actively traded artists in the international auction market.

As an example, see below the top five artists in the high price high market activity group given current crowd source weights. Sign up for free to see results based on your own weights.